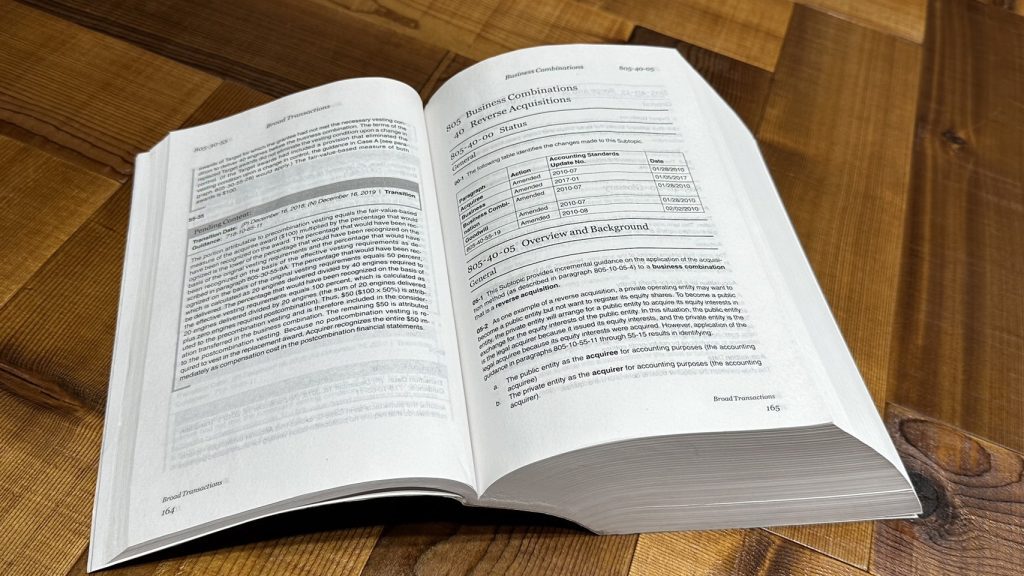

Accounting Treatment of Goodwill in SPAC Mergers

The original article is in Japanese. The following is a summary of its content. The Rise of Goodwill Impairment in SPAC Deals A Wall Street Journal article in April 2023 highlighted that companies which went public via Special Purpose Acquisition Companies (SPACs) have recorded significant goodwill write-downs. This trend suggests that initial acquisition prices may …

A.L.I. Lists on Nasdaq via De-SPAC

(Image courtesy of the AERWINS website.) On February 6, 2023, the holding company of A.L.I. Technologies (A.L.I.), a developer of air mobility solutions including drones and hoverbikes, completed its merger (De-SPAC) with a U.S. SPAC (Pono Capital Corp.). The company changed its name to AERWINS Technologies Inc. and was listed on Nasdaq. A.L.I.’s Path to …

Coincheck to List on Nasdaq via SPAC

Coincheck to List on Nasdaq via SPAC On March 22, 2022, Monex Group, Inc. announced that its subsidiary Coincheck, Inc., which operates a crypto asset exchange business, will list on the U.S. Nasdaq market within the year through a merger with a Special Purpose Acquisition Company (SPAC). It was believed that several other companies in …

The Potential for FPI Listings via SPAC Schemes

Regarding SPACs, a topic on which we continue to receive many inquiries, a very interesting case has recently emerged that we would like to introduce. Note: For details on the standard SPAC listing scheme, please see this article:“A Look Behind the Scenes of a U.S. SPAC Listing, Explained Using the Largest Deal of 2020“ A …

Introduction of our audit/attestation and advisory service

A common challenge foreign companies with relatively small subsidiaries in Japan face is monitoring over the operation of the Japanese subsidiary. Especially when it comes to financial reporting. This might not be an issue for companies that engage with the large international audit firms like PwC, Deloitte, KPMG and EY. Their counterparts in Japan will …

SPAC Raises Funds 100 Times Larger Than the Entire Tokyo Stock Exchange

What is a SPAC? Evo Acquisition, a blank check company targeting the tech and financial industry, on February 9th raised approximately $109 million. Following the surge of IPOs by other black check companies, Evo Acquisition plans to list on the Nasdaq under the symbol of EVOJU. Evo Acquisition is a special purpose acquisition company (SPAC), …

A Look Behind the Scenes of a U.S. SPAC Listing, Explained Using the Largest Deal of 2020

Introduction Regarding SPACs, a topic on which our firm receives inquiries almost weekly, we will use the case of QuantumScape Corporation, said to be the largest SPAC deal of 2020, to explain how they are specifically formed and what requirements and procedures are necessary. QuantumScape was originally a solid-state battery developer founded in 2010 by …