The original article is in Japanese. The following is a summary of its content.

The Rise of Goodwill Impairment in SPAC Deals

A Wall Street Journal article in April 2023 highlighted that companies which went public via Special Purpose Acquisition Companies (SPACs) have recorded significant goodwill write-downs. This trend suggests that initial acquisition prices may have been inflated or that business projections were overly optimistic.

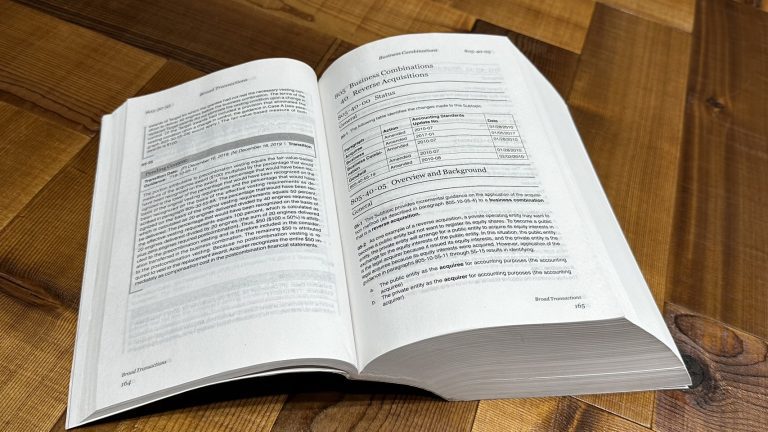

However, the article notes that one style of SPAC deal, a reverse merger, does not result in the recognition of goodwill. This points to two distinct accounting treatments for SPAC integrations, determined by which entity is considered the “accounting acquirer.”

Scenario 1: SPAC as the Accounting Acquirer

In this scenario, the transaction is treated as a standard business combination under ASC Topic 805, Business Combinations. Goodwill is recognized if the acquisition price exceeds the fair value of the target company’s net assets.

Scenario 2: Operating Company as the Accounting Acquirer (Reverse Acquisition)

This scenario occurs when the target operating company’s (the “legal” target) shareholders and management retain substantive control of the combined entity post-merger.

Control is determined by factors such as:

- Holding the largest voting interest.

- The ability to appoint a majority of the board.

- Retaining control of day-to-day operations (as seen in the Aurora Innovation Inc. disclosure).

Accounting Treatment for Reverse Acquisitions: Reverse Recapitalization

Under US GAAP, if the SPAC is a shell company and does not meet the definition of a “Business,” the transaction is not treated as a business combination. Instead, it is accounted for as a Reverse Recapitalization.

In a Reverse Recapitalization, no fair value assessment is performed, and no goodwill is recognized. The transaction is treated as the equivalent of the operating company issuing shares to acquire the net assets of the SPAC.

Comparison with IFRS Treatment

IFRS similarly requires an analysis of which entity is the acquirer. If the transaction is deemed a reverse acquisition, IFRS 2 (Share-based Payment) is applied. This treats the transaction as the operating company issuing “deemed shares” as payment to acquire the SPAC’s assets and cover the cost of listing, with listing expenses recognized in the income statement.