Speaking at a Money Forward Online Seminar

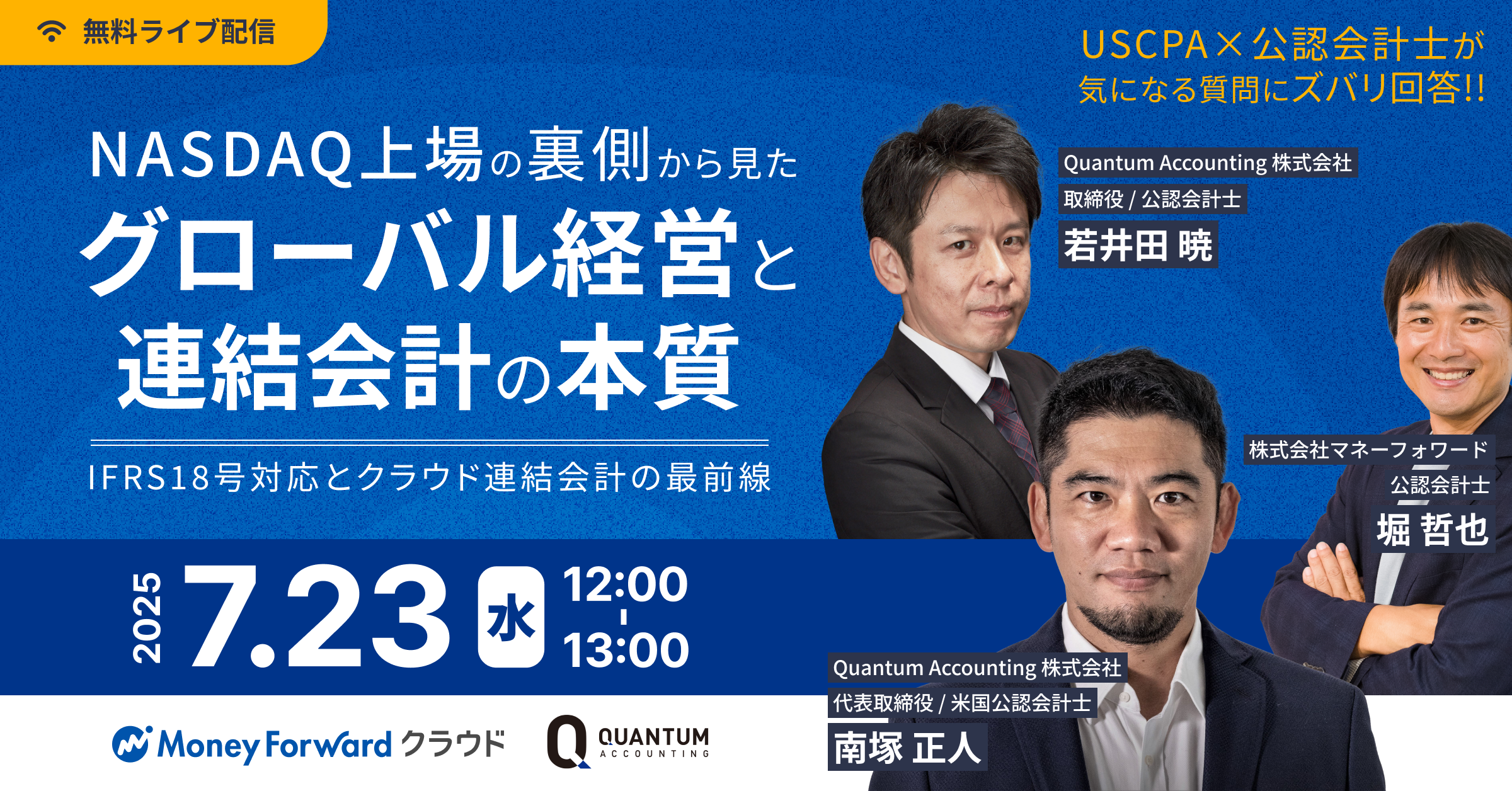

The Essence of Global Management and Consolidated Accounting Seen Through the Lens of NASDAQ Listing ~ IFRS 18 Compliance and the Cutting Edge of Cloud-Based Consolidated Accounting ~ We hope this message finds you well. We are pleased to announce that our CEO, Mr. Masato Minamitsuka, and Director, Mr. Satoru Wakaida, will be speaking at an online seminar hosted by Money Forward, Inc. This seminar will feature a panel discussion on the essence of global management and consolidated accounting, drawing from our extensive experience in NASDAQ listing support and International Financial Reporting Standards (IFRS) implementation. ■ Seminar Title The Essence of Global Management and Consolidated Accounting Seen Through the Lens of NASDAQ Listing ~ IFRS 18 Compliance and the Cutting Edge of Cloud-Based Consolidated Accounting […]