This article is an update to our post from December 15, “[Nasdaq: Rule Revisions Regarding Board Diversity]”

Overview of the Board Diversity Rule

In December of last year, Nasdaq compiled and submitted a proposed rule change regarding board diversity to the SEC. On August 6, 2021, the SEC approved this regulatory amendment.

The purposes of the diversity rule are (1) to promote diversity among the directors of Nasdaq-listed companies, and (2) to provide shareholders with disclosure of board diversity. Under this rule, companies listed on Nasdaq are required to appoint at least two diverse directors or, if they cannot meet this requirement, explain the reason for not doing so in their proxy statement for the annual shareholders’ meeting, on their website, or in other public disclosures.

An individual recognized as “diverse” is defined as someone who identifies as female, an underrepresented minority, or LGBTQ+. Companies must appoint at least one individual who self-identifies as female, and at least one additional individual who self-identifies as either a racial minority (as defined below) or LGBTQ+.

“Minority” is defined as an individual who self-identifies as any of the following: Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or as belonging to two or more races or ethnicities.

“LGBTQ+” is defined as an individual who self-identifies as Lesbian, Gay, Bisexual, Transgender, or as a member of the queer community.

If a company fails to comply with this rule, or fails to disclose its explanation for non-compliance, it must return to compliance by a deadline specified by Nasdaq. Failure to do so may result in Nasdaq issuing the company a Staff Delisting Determination, which could lead to delisting.

New Rules Regarding Disclosure

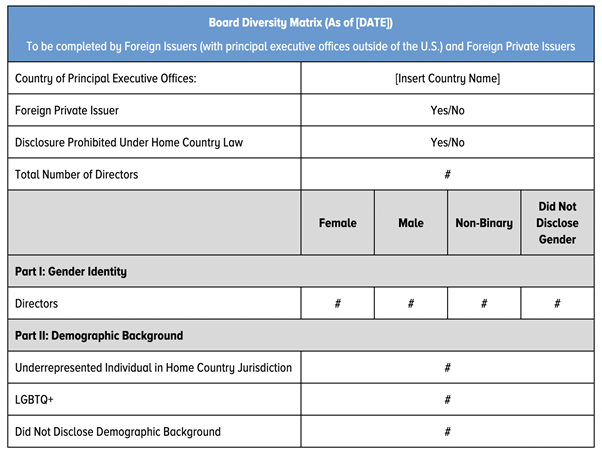

All Nasdaq-listed companies are required to disclose board-level diversity statistics for the current and prior year annually. This disclosure must be made in the proxy statement for the annual shareholders’ meeting (or in the Form 10-K or Form 20-K if the company does not file a proxy) or on the company’s website.

The disclosure must be made using the “standardized disclosure matrix template” provided (see below) or in a format that is “substantially similar” to the matrix.

Please refer here for Nasdaq’s examples of acceptable and unacceptable disclosures.

If a company’s disclosure is not accepted by Nasdaq, it must submit a plan to comply with the listing standards. If it fails to submit a plan, or if the submitted plan is not accepted, the company may be delisted.

The SEC is scheduled to announce its own new rules regarding board diversity disclosure in the latter half of 2021.

Conclusion

ESG (Environment, Social, Governance) has become widespread and deeply rooted globally, and the proportion of ESG investment is rising. Diversity is part of the “S” (Social) in ESG. ESG investment emphasizes “non-financial information,” such as greenhouse gas emissions and the ratio of female managers, in addition to financial data. This is based on the belief that companies with high ESG ratings gain support from stakeholders, including investors and consumers, leading to long-term increases in sales and profits. In other words, non-financial information is a “source of a company’s sustainable growth.”

In the U.S. bioscience industry where I (the author) previously worked, the percentage of female researchers was high, and the workforce was diverse in race and LGBTQ+ members. Thanks in part to this, ideas and opinions from various perspectives were actively exchanged, and global collaboration was frequent. The research outcomes as a university were very high, including Nobel Prizes. As a result, they succeeded in gathering abundant research funding compared to Japan.

We hope that companies considering a listing will incorporate diversity not just because it is a listing requirement, but for their own long-term and global growth.

To that end, our firm is committed to actively supporting companies considering a listing—not only with their Nasdaq ambitions but also with their long-term growth. Please feel free to contact us.

Please also review the following article:

For questions or consultations regarding this page, please feel free to contact us using the inquiry form below.